Whistleblowers are one of the most important ways that Americans can help prevent fraud, waste, and corruption in our public systems. Becoming a whistleblower is an act of civil service. Speaking up about waste and wrongdoing saves taxpayer funds, redirects government spending to where it can do the most good, helps protect the needy and most vulnerable, and lowers the cost of services for everyone.

Federal, state, and local governments are empowered to protect whistleblowers through a series of laws and legislation, many of which are designed to stop employers from retaliating against employees or their loved ones for speaking up and doing the right thing in cases of fraud. Often, these laws not only protect whistleblowers but also offer financial incentives for those who come forward to report fraudulent activity.

If you have information that might help recover government funds that have been misappropriated, you may be eligible to become a whistleblower in a qui tam case. Whether these funds are local, state, or federal, there are laws in place to help you take action.

Whistleblowers are often the first and most important line of defense against fraud. If you suspect you might be able to help, do not wait. Do the right thing, and protect your own interests at the same time. The expert law firm of Tycko & Zavareei LLP is available to help you navigate the process of blowing the whistle. Our team of elite attorneys fight for our clients’ rights and to achieve the greatest amount of compensation available while doing the greatest amount of public good.

Understanding the Federal False Claims Act

One of the strongest and most important whistleblower laws in the United States is the False Claims Act. First passed by President Lincoln in 1863 during the American Civil War, the False Claims Act was designed to battle rampant defense contractor fraud. The law has since been amended many times to encompass healthcare fraud, cyber fraud, government contracts fraud, and more. Of these, the most common implementation of the False Claims Act is currently addressing healthcare fraud, which costs taxpayers billions of dollars every year, according to the Department of Justice.

The False Claims Act states that anyone who knowingly makes false claims to the government can be held liable for up to treble damages, plus an individual financial penalty assessed for each false claim. The amount for this penalty is linked to inflation. Whistleblowers who report fraudulent claims under the False Claims Act may be eligible to receive up to 30 percent of the government’s total recoupment in the event of a successful qui tam case.

SEC Securities Fraud

The SEC Whistleblower Program was created to incentivize those with knowledge of securities, banking, and commodities fraud to come forward. In cases that involve monetary sanctions of over $1 million, whistleblowers may be eligible to receive anywhere from 10 to 30 percent of the overall award under the SEC Whistleblower Program.

Like in qui tam cases under the False Claims Act, whistleblowers are protected via the SEC Whistleblower Program against retaliatory actions by employers. Some prohibited retaliatory acts include:

- Reduction of pay

- Reduction of hours

- Harassment or threats

- Demotion or termination

CFTC: Commodity Trading Fraud

The Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law in 2010 by President Obama, created the Commodity Futures Trading Commission’s Whistleblower Office. Whistleblowers who come forward to provide previously undisclosed and unreported information about fraud in the commodities market may be eligible to receive financial awards and incentives. A whistleblower’s financial award can vary from 10 to 30 percent of any monetary recovery collected in the event of a successful claim.

IRS: Tax Fraud

The average person may know more about tax fraud than all other kinds of reportable government fraud. However, most people are not aware that in cases of tax fraud, underpayment, and evasion in excess of $2 million, the IRS Whistleblower Program rewards financial compensation to those who come forward with information that leads to the successful collection of defrauded taxes.

There is no dollar cap on the amount that can be awarded to whistleblowers in cases of IRS tax fraud. Whistleblower rewards range from 15 to 30 percent of the government’s total recovery and can be enormous in cases of ongoing tax evasion. While the IRS Whistleblower Program outlines that whistleblower rewards are mandatory in cases of successful recovery, they can be reduced if the whistleblower was shown to have planned or perpetrated the tax fraud scheme.

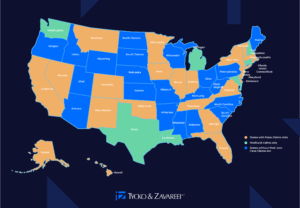

State Whistleblower Laws

State whistleblower laws are similar to federal whistleblower laws in that they seek to help recoup misappropriated public funds and protect those who come forward with helpful information. However, they only address fraud that happens at the level of state or local governments, as opposed to fraud at the federal level. Many whistleblower cases involve partially-state funded Medicaid programs, state government contracts, or more.

See the map below for a complete overview of state-level False Claims Acts.

States with False Claims Acts

- Alaska

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Illinois

- Indiana

- Iowa

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Montana

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Oklahoma

- Rhode Island

- Tennessee

- Texas

- Vermont

- Virginia

- Washington

While 30 states and the District of Columbia all have their own False Claims Acts, certain states’ whistleblower laws are limited to protecting Medicaid claims only. These states are:

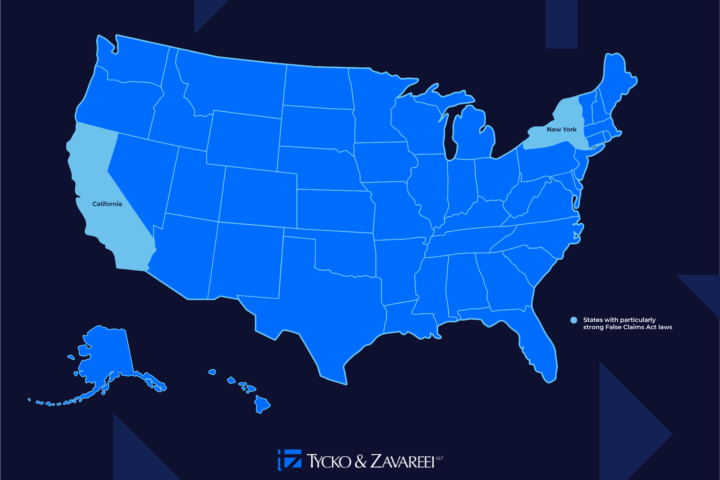

Other states, however, have particularly strong whistleblower laws. Some examples of these include California and New York.

California Whistleblower Law

The California False Claims Act was adopted in 1987 and is one of the most powerful state whistleblower laws in the nation. It owes some of its strength in part to its assignment of liability by “political subdivision.” This means that any attempt to defraud not only the state government but also any of the cities and townships throughout the state is also covered by this law. Whistleblowers are eligible to receive 15 to 33 percent of recovered funds in the event of a successful qui tam action.

New York Whistleblower Law

The New York False Claims Act offers qui tam provisions as strong as the federal FCA aimed at helping whistleblowers recoup up to 30 percent of misappropriated government funds. This state finance law covers local government contracts, such as municipalities and school district funds, as well as state funds. Unlike its federal counterpart, the New York FCA covers tax fraud. If a party is found liable, under the New York False Claims Act they may be subjected to financial penalties, treble damages, and attorney’s fees.

Coming Forward as a Whistleblower

Making the decision to speak out as a whistleblower can be difficult, but it is the right one. Just some of the reasons why you should come forward as a whistleblower include:

- Protection from retaliation via federal and state legislation

- The prospect of receiving a significant financial award

- Reducing fraud, misuse, and waste in your industry

- Protecting the most vulnerable

- Recouping taxpayer funds so they can be spent on what matters most

Reach out to Tycko & Zavareei LLP Today

If you have more questions about blowing the whistle on fraud and corruption, do not hesitate. The expert team at Tycko & Zavareei LLP is available to answer any questions you might have and help you understand all of the options available to you.

If you have information that might help recover misappropriated government funds, speaking to a qui tam lawyer should be your first step. Call us today or schedule a complimentary case consultation online.